Establish a Clear Process from the Start

A well-defined process ensures efficiency and accountability in data request management. Start by assigning a dedicated data request manager responsible for coordinating requests and ensuring clear ownership across functional teams like legal, finance, IT, and HR. To avoid bottlenecks, establish an escalation process for when key stakeholders are unavailable.

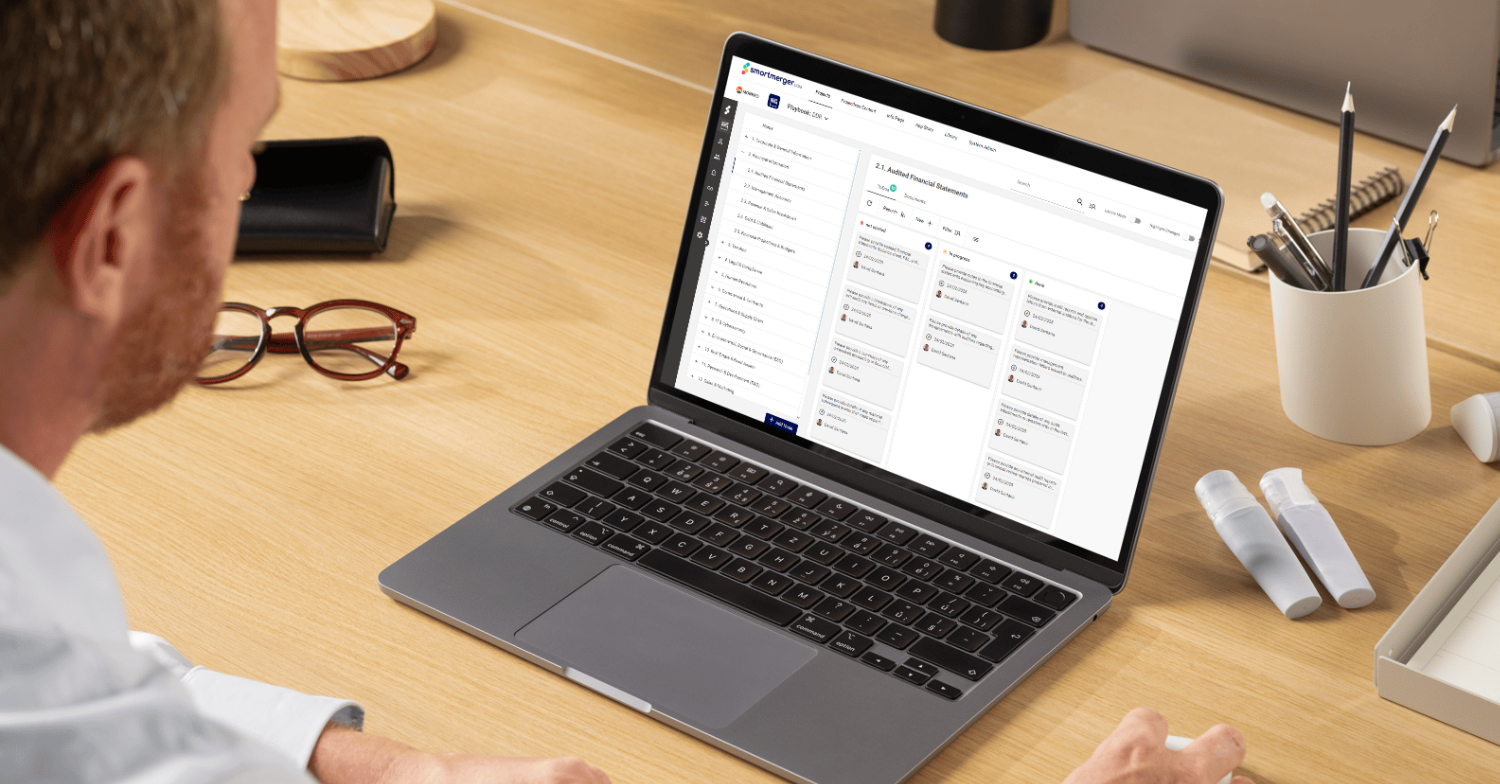

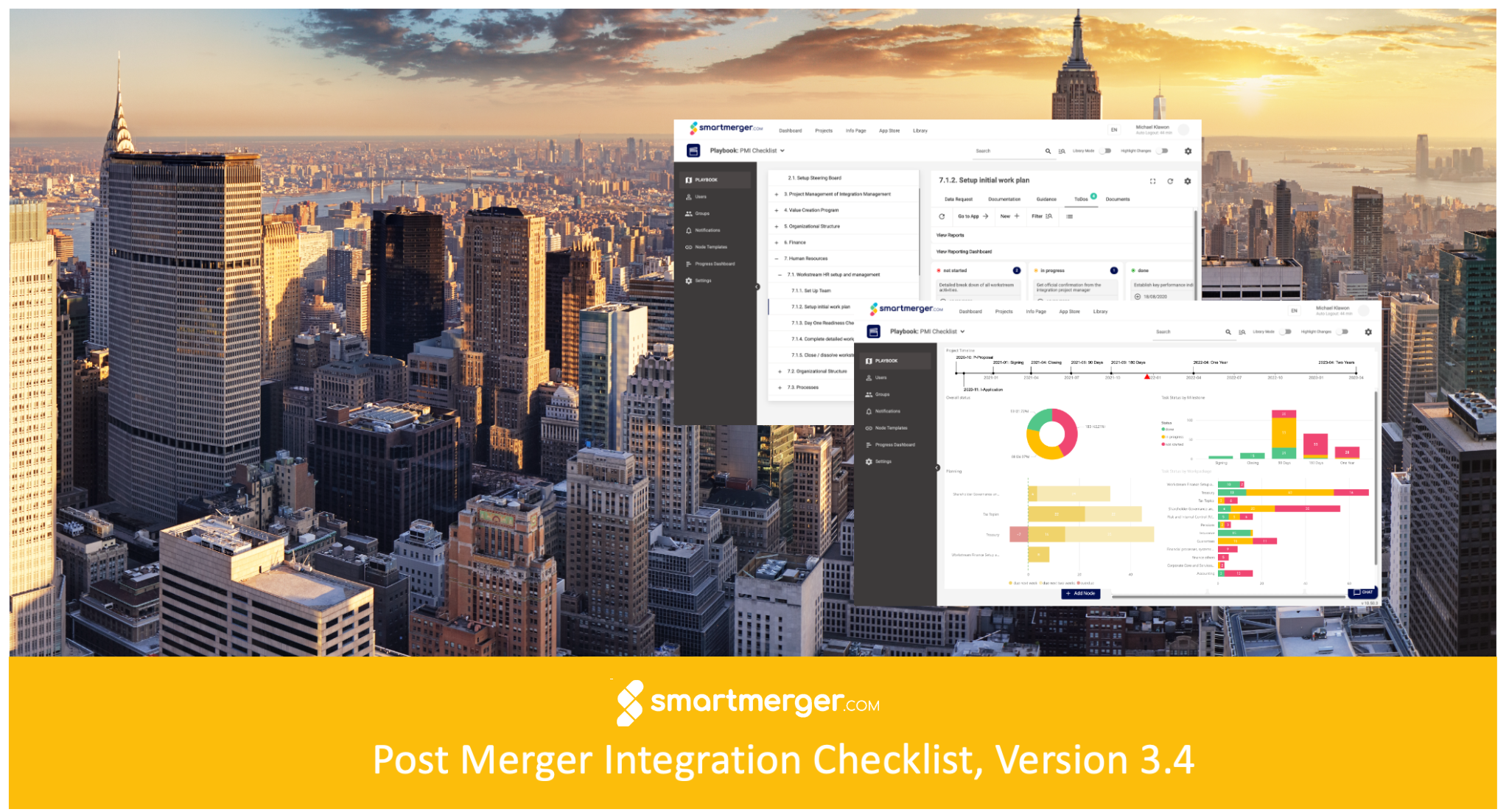

Using a centralized system is essential for managing requests, documents, and communications efficiently. An M&A platform should allow for real-time tracking, access control, secure document sharing, and audit trails to enhance transparency. Integration with commonly used tools such as PitchBook or Power BI further streamlines workflows. Additionally, using a standardized request list grouped into logical categories—such as finance, contracts, and operations—helps maintain clarity. Starting with a predefined Data Request List (DRL) tailored to the deal type and allowing real-time updates ensures flexibility as the transaction evolves.

A structured approach at the outset prevents delays and confusion while creating a clear foundation for the next steps: communication and tracking.